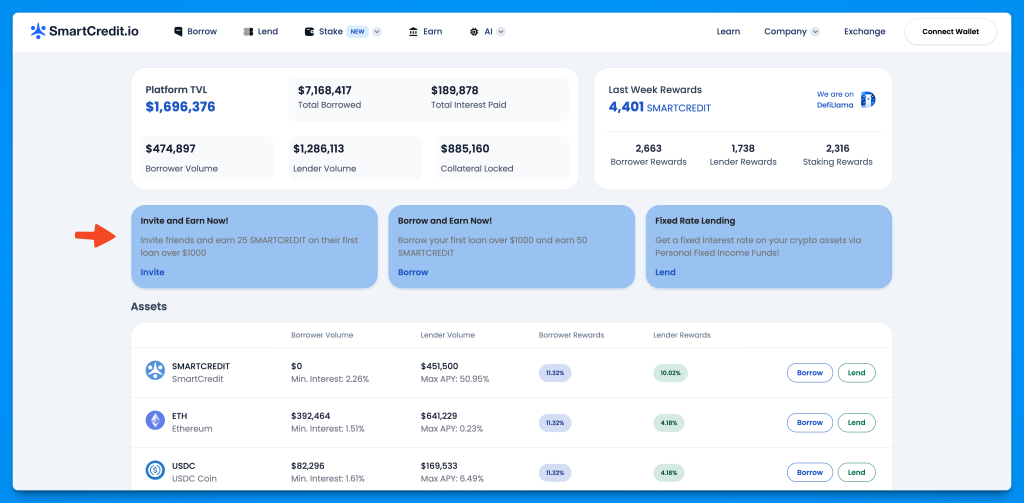

SmartCredit.io is a decentralized peer-to-peer global lending marketplace connecting lenders and borrowers without intermediaries. As an AI-driven, self-custodial neobank, SmartCredit.io enables DeFi fixed-term/fixed-interest loans for borrowers, personal fixed-income funds for lenders, and fixed-rate leveraged staking options for investors. In a competitive, rapidly evolving DeFi landscape, SmartCredit.io aimed to enhance user engagement and improve its overall conversion rates.

Initial Marketing Setup

Before ChainAware.ai integration, SmartCredit.io relied primarily on organic traffic and social media engagement, particularly through Google, Twitter and Telegram, to attract users. While organic methods brought consistent interest, the team faced challenges in translating general curiosity into meaningful user actions like extended session duration, wallet connections, and ultimately, successful lending or borrowing transactions.

Key Challenges

- Low Conversion Rates: Although SmartCredit.io’s platform attracted visitors, turning those visitors into active users or borrowers/lenders proved difficult.

- Limited Engagement: The platform struggled to keep users engaged long enough to perform key actions or learn about new features due to broad messaging not tailored to individual user segments.

- Need for Personalization: With targeted, data-driven strategies, it was easier to deliver personalized offerings that matched user interests, needs, and lifecycle stages.

Goals and Objectives

SmartCredit.io partnered with ChainAware.ai to:

- Increase user engagement by delivering more relevant, personalized messages within the platform.

- Enhance secondary conversion actions, such as encouraging wallet connections, extended time on-site, and exploring in-app features.

- Improve the primary conversion metric: successful lending or borrowing transactions by guiding users toward the most suitable financial products.

The ChainAware.ai Solution

SmartCredit.io created an enterprise account with ChainAware.ai and seamlessly integrated ChainAware.ai’s Web3 Marketing Agent by adding a pixel code to their platform. This quick technical setup enabled real-time user data collection, segmentation, and personalized message delivery.

Products Utilized:

- Personalized Advertising Messages: Using ChainAware.ai’s Banner Configurator, the SmartCredit.io team crafted tailored messages for different user personas. By combining user behavioral data with on-chain data insights, the platform delivered contextually relevant content—whether it was explaining lending opportunities to new visitors or highlighting staking options to seasoned investors.

- Data-Driven Targeting: The platform leveraged ChainAware.ai’s audience segmentation tools to ensure each persona received the right message at the right time, increasing the likelihood of meaningful engagement.

- In-App Targeting Enhancements: By dynamically adjusting in-app banners and prompts, SmartCredit.io encouraged deeper exploration of the platform’s features, driving users toward key actions that aligned with their goals—such as connecting wallets or initiating a lending transaction.

Watch on YouTube: ChainAware.ai in 3 Minutes

Strategy and Execution

The execution phase began with a series of brainstorming sessions to identify distinct user personas. For example, new users might receive educational content explaining the DeFi lending concept, while wallet connected visitors might be presented with tailored lending opportunities. After finalizing these message sets, SmartCredit.io activated targeted campaigns within the ChainAware.ai platform. This iterative approach ensured ongoing optimization: messages and campaigns were refined based on performance insights to continually improve user experience and conversion rates.

Results and Performance Metrics

Over a six-month period, SmartCredit.io observed:

- 8x Improvement in Secondary Conversion Actions: Time spent on site increased, more users connected their wallets, and overall app usage grew significantly, demonstrating that personalized, data-driven messaging encouraged deeper platform engagement.

- 2x Increase in Main Conversion Action: Successful lending or borrowing transactions doubled, as targeted strategies guided users more effectively through the funnel toward meaningful financial actions.

The SmartCredit.io team noted a stronger sense of alignment between their brand and user experience. By presenting relevant, timely information, they reduced friction in the conversion process. Internally, the marketing and product teams recognized that this targeted, data-backed approach allowed them to focus on quality user engagement, rather than relying solely on volume-driven tactics.

Learn More: Web3 Marketing Agent