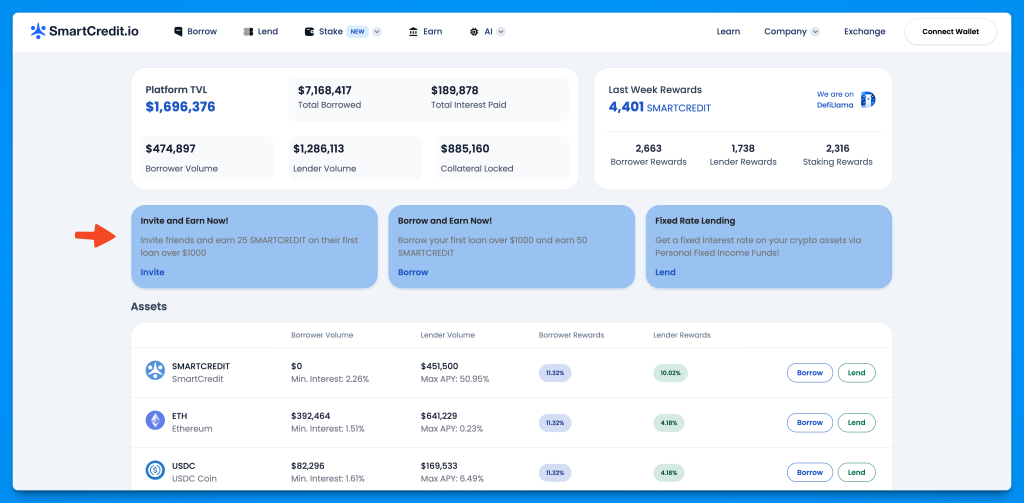

SmartCredit.io is a decentralized peer-to-peer global lending marketplace connecting lenders and borrowers without intermediaries. As an AI-driven, self-custodial neobank, SmartCredit.io enables DeFi fixed-term/fixed-interest loans for borrowers, personal fixed-income funds for lenders, and fixed-rate leveraged staking options for investors.

In a competitive, rapidly evolving DeFi lending landscape, SmartCredit.io faced a challenge familiar to almost every Web3 platform: plenty of wallet connections, but frustratingly low conversion into the actions that actually matter — lending, borrowing, and sustained platform engagement.

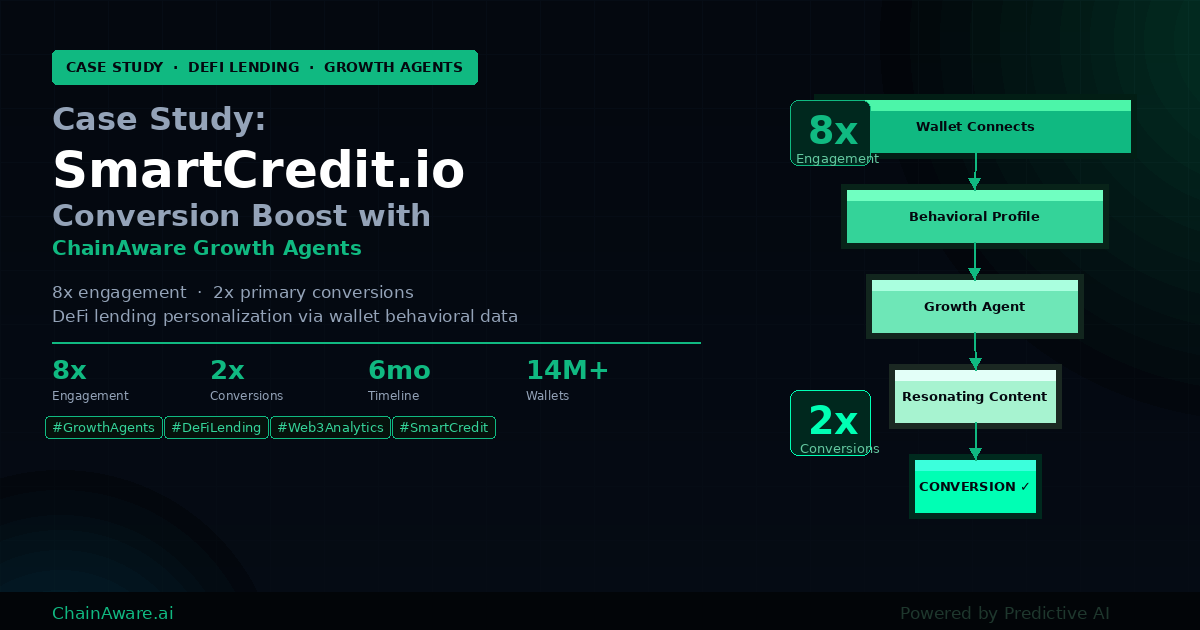

This case study documents how SmartCredit.io solved that problem by integrating ChainAware.ai’s Web3 Growth Agents and Behavioral Analytics — and the measurable results achieved over a six-month period.

Key Results at a Glance: 8x improvement in secondary conversions (engagement, wallet connections, session duration) | 2x increase in primary conversions (lending/borrowing transactions) | 6-month implementation period

The Challenge: High Traffic, Low Conversion

Before integrating ChainAware.ai, SmartCredit.io relied primarily on organic search traffic, Google Ads, Twitter/X, and Telegram community activity to attract users. These channels brought consistent interest — wallets were connecting, visitors were landing on the platform — but the conversion funnel told a different story.

Three specific problems defined the pre-integration state:

1. Low Primary Conversion Rate

The gap between users connecting their wallet and users completing a lending or borrowing transaction was large. Visitors would explore the interface, perhaps read about the lending mechanics, and then leave without taking action. The platform had no way to understand why a given wallet wasn’t converting — or what it would take to change that.

2. Poor Secondary Engagement

Session durations were short. Feature exploration was shallow. Most users who connected their wallet weren’t discovering the platform’s full product range — fixed-income funds, leveraged staking, peer-to-peer loans — because the platform couldn’t guide them toward the products most relevant to their specific financial behavior and risk tolerance.

3. Generic Messaging to a Non-Generic Audience

Every user — whether a conservative yield-seeker with $500 in stablecoins or a sophisticated DeFi investor managing a multi-protocol strategy — received the same onboarding experience, the same in-app banners, and the same calls to action. This one-size-fits-all approach was the root cause of all three problems.

According to McKinsey’s research on personalization, companies that fail to personalize at the behavioral level lose 20–25% of their potential revenue to competitors who do. In DeFi lending, where margins are tight and user trust is hard-won, that gap is existential.

Root Cause: Generic Messaging to Non-Generic Users

The deeper problem was a fundamental lack of user intelligence. SmartCredit.io’s team knew their product well — but they didn’t know their users. Not in the way that drives decisions.

Specifically, they lacked answers to three critical questions:

- Who are our users really? Not just wallet addresses — but what is their DeFi experience level, their risk tolerance, their protocol history, their predicted next action?

- Are we attracting the right users? DeFi lending requires users who are willing to take on counterparty risk and commit capital for fixed terms. Are the wallets arriving on the platform behaviorally aligned with this product type?

- What should we say to each user? A message that resonates with a conservative stablecoin lender will fall completely flat with an aggressive leveraged staking user — and vice versa. Without behavioral segmentation, every message is a guess.

This is the exact problem that ChainAware.ai’s Web3 Growth Agents and Behavioral Analytics are designed to solve.

The Solution: Web3 Growth Agents + Behavioral Analytics

SmartCredit.io integrated two ChainAware.ai products in combination:

- Web3 Growth Agents — to automatically capture each wallet’s behavioral profile at the moment of connection and generate personalized in-app content in real time

- Web3 Behavioral Analytics — to understand the full composition of SmartCredit.io’s user base: who they actually are, what they intend to do, and whether they’re the right users for a DeFi lending platform

The technical integration was simple: a pixel code added to SmartCredit.io’s platform. From that point, every wallet connection triggered the full behavioral intelligence pipeline automatically.

For DeFi Platforms & Dapp Teams

See What Growth Agents Would Do for Your Platform

Audit any wallet to see exactly what behavioral data ChainAware.ai has — risk profile, experience level, predicted next actions, Wallet Rank. Free, instant, no signup required.

How Growth Agents Work: The Mechanics Behind the Results

Understanding what Growth Agents actually do explains why the results were so dramatic. The mechanism is a two-step process that fires automatically every time a user connects their wallet to a Dapp.

Step 1: Wallet Connection Triggers Behavioral Profiling

The moment a user connects their Web3 wallet to SmartCredit.io, the Growth Agent captures the wallet address and immediately queries ChainAware.ai’s predictive data layer. Within milliseconds, the agent receives back a complete behavioral profile:

- Behavioral category — is this wallet a DeFi lender, an active trader, an NFT collector, a bridge user, or a newcomer? This single classification immediately determines which product narrative is most relevant.

- Experience level — how long has this wallet been active in Web3? How many protocols has it used? A veteran DeFi user and a first-timer need completely different onboarding experiences.

- Risk willingness — does this wallet’s history show a preference for conservative, stable yields or aggressive, high-variance strategies? For SmartCredit.io, this determines whether to lead with fixed-income funds (conservative) or leveraged staking (aggressive).

- Prediction scores — what actions is this wallet most likely to take next? High borrowing probability means the Growth Agent should lead with loan products. High staking probability means leveraged staking takes center stage.

- Wallet Rank — the wallet’s multi-chain reputation score based on genuine on-chain activity. High-rank wallets can be identified as premium prospects and receive VIP-level messaging.

- Credit Score — for a lending platform specifically, the wallet’s borrower reputation score is immediately actionable: high-credit wallets can be offered preferential loan terms automatically.

Step 2: Behavioral Context Drives Content Generation

With the behavioral profile in hand, the Growth Agent generates content that directly resonates with that specific wallet’s situation. This is not a template with a variable swapped in. It’s genuinely different content for each behavioral segment:

- A conservative stablecoin holder new to DeFi sees an educational banner explaining how SmartCredit.io’s fixed-term lending works, with emphasis on predictable returns and capital protection

- A seasoned DeFi investor with a history of leveraged positions sees a direct invitation to explore fixed-rate leveraged staking, with specific APY numbers upfront

- A wallet with high borrowing probability and good Credit Score sees a pre-approved loan offer with favorable terms — reducing friction to zero

- A new wallet with no DeFi history sees a simplified onboarding flow that explains the concept of peer-to-peer lending before asking for any commitment

Each user experiences a platform that appears to understand them — because it does. The behavioral data from 14M+ wallets across 8 blockchains means that even pseudonymous addresses arrive with a rich, actionable profile.

For the full technical architecture of how Growth Agents work, see our complete guide on Prediction MCP for AI agents and our overview of how to use ChainAware.ai as a business.

How Behavioral Analytics Revealed SmartCredit.io’s Real Users

Before deploying personalized Growth Agent content, SmartCredit.io used ChainAware.ai’s Web3 Behavioral Analytics to answer a question that most DeFi platforms never seriously ask: who are our users, really?

This step is more important than it might seem — and it revealed insights that fundamentally shaped the campaign strategy.

Understanding User Intentions

Behavioral Analytics showed SmartCredit.io the distribution of intentions across their user base. What were connecting wallets actually trying to accomplish? The data revealed distinct segments:

- A significant portion of connecting wallets had high borrowing intent — they were actively looking for loan products, making them high-priority targets for direct borrowing CTAs

- Another segment had clear yield-seeking behavior but conservative risk profiles — the ideal audience for fixed-income fund positioning

- A third group showed exploratory behavior with no clear intent — requiring educational content before any product pitch

Understanding User Experience Levels

Behavioral Analytics also revealed the experience distribution of SmartCredit.io’s user base — how Web3-native their visitors actually were. This matters enormously for messaging: the same explanation of “collateralized lending” that is immediately clear to a DeFi veteran is completely opaque to a crypto newcomer.

Knowing the experience breakdown allowed SmartCredit.io to calibrate the sophistication level of each Growth Agent message appropriately — no more over-explaining to experts, no more under-explaining to newcomers.

Understanding Risk Willingness

Perhaps the most strategically important insight was risk willingness. SmartCredit.io offers products across the risk spectrum — from highly conservative fixed-income funds to more aggressive leveraged staking positions. Behavioral Analytics showed that a substantial portion of connecting wallets had conservative risk profiles.

This had two implications. First, it confirmed that leading with conservative, capital-preservation messaging was the right strategy for the majority of users. Second, it raised a strategic question: was SmartCredit.io attracting enough high-risk-tolerance wallets for its leveraged products? If not, were there platform adjustments or channel changes that could shift the audience mix?

This is the deeper value of Behavioral Analytics: it doesn’t just optimize your messaging to existing users — it tells you whether you have the right users for your product, and gives you the data to find more of them if you don’t.

According to Harvard Business Review’s research on AI-driven customer intelligence, companies that build a clear behavioral understanding of their users make measurably better product, marketing, and growth decisions. For SmartCredit.io, the Analytics data became the foundation for every subsequent campaign decision.

See our full guide on why personalization is the next big thing for AI agents in Web3 for the broader context on why behavioral intelligence drives better outcomes.

Understand Your Real Users

What Do Your Dapp’s Wallets Actually Intend to Do?

Web3 Behavioral Analytics reveals the real intentions, experience levels, and risk willingness of every wallet connecting to your platform — so you know exactly who you’re building for and how to reach them.

Execution: Persona Mapping and Campaign Setup

Armed with behavioral intelligence from both Analytics and Growth Agents, SmartCredit.io’s team ran a series of strategy sessions to map behavioral segments to specific message sets. The process followed a clear structure:

Persona Definition

The team identified four primary personas based on the Behavioral Analytics data:

- The Conservative Yield Seeker — experienced enough to understand DeFi basics, risk-averse, primarily interested in predictable fixed-income returns. Target product: personal fixed-income fund. Message focus: capital protection, predictable APY, no impermanent loss.

- The Active DeFi Borrower — moderate-to-high experience, needs capital, has collateral, looking for better rates than traditional DeFi lending. Target product: fixed-term/fixed-interest loan. Message focus: competitive rates, fixed terms, no liquidation risk from rate volatility.

- The Leverage Investor — high experience, high risk tolerance, comfortable with leveraged positions. Target product: fixed-rate leveraged staking. Message focus: yield amplification, fixed costs, defined upside.

- The DeFi Newcomer — low experience, unclear intent, likely discovering DeFi lending for the first time. Target product: education-first onboarding. Message focus: how peer-to-peer lending works, why SmartCredit.io is safer than alternatives, a simple first step.

Content Mapping and Banner Configuration

Using ChainAware.ai’s Banner Configurator, SmartCredit.io built specific message sets for each persona. Each set included:

- A primary in-app banner with a persona-specific headline and CTA

- A secondary message triggered after wallet connection confirmation

- A feature-highlight prompt targeting the product most aligned with the persona’s behavioral profile

Iterative Optimization

The campaign wasn’t set-and-forget. SmartCredit.io ran continuous A/B tests across message variants for each persona, using conversion data to refine headlines, CTAs, and timing. Messages that underperformed for a given behavioral segment were replaced with alternatives. Over the six-month period, this iterative approach compounded into the final performance numbers.

According to Salesforce research, 73% of consumers expect brands to understand their unique needs — and brands that deliver personalization consistently outperform those that don’t on both conversion and retention. The iterative optimization process is what closed the gap between “good personalization” and “great personalization.”

Results: 8x Engagement, 2x Conversions in 6 Months

Over the six-month implementation period, SmartCredit.io observed two categories of results.

8x Improvement in Secondary Conversion Actions

Secondary conversions — session duration, wallet connection depth, feature exploration, return visits — improved by 8x compared to the pre-integration baseline. Users were staying longer, going deeper into the platform, and discovering products they had previously missed entirely.

This result reflects the power of the behavioral match: when Growth Agents surface the right product at the right moment for the right user, exploration becomes natural rather than effortful. Users don’t need to hunt for relevance — it’s presented to them immediately.

2x Increase in Primary Conversion Actions

Primary conversions — successful lending and borrowing transactions — doubled. This is the number that directly impacts SmartCredit.io’s revenue and TVL. A 2x improvement in transaction conversion from the same traffic volume is equivalent to doubling the effective yield of every marketing dollar spent on user acquisition.

The SmartCredit.io team attributed this to two specific Growth Agent behaviors: first, the immediate presentation of a relevant product offer at wallet connection (reducing the path from arrival to action), and second, the Credit Score-based pre-approval messaging for high-credit borrowers (reducing the perceived friction of initiating a loan).

Qualitative Outcomes

Beyond the metrics, the SmartCredit.io team noted a stronger sense of brand-user alignment. Users who received personalized experiences were more likely to share feedback, refer others, and return to the platform for subsequent transactions. The platform’s reputation for “understanding its users” became a differentiator in community discussions — an intangible benefit with compounding long-term value.

For more on the DeFi growth levers that complement this approach, see our guide on 5 ways Prediction MCP turbocharges DeFi platforms.

Build Your Own Growth Agent Integration

Want to Replicate SmartCredit.io’s Results?

Growth Agents and Behavioral Prediction MCP give you the same behavioral intelligence SmartCredit.io used — wallet profiling, intent prediction, and personalized content generation. One pixel or one MCP endpoint away.

Key Lessons for DeFi Platforms

The SmartCredit.io case study surfaces four lessons that apply to any DeFi platform struggling with conversion:

Lesson 1: You Don’t Know Your Users Until You Measure Their On-Chain Behavior

Team intuitions about who your users are and what they want are almost always wrong in important ways. Behavioral Analytics reveals the truth — and the truth is almost always more nuanced, and more actionable, than the assumption.

Lesson 2: Platform-User Fit Matters as Much as Product-Market Fit

SmartCredit.io’s Behavioral Analytics revealed whether the wallets arriving on their platform were actually the right wallets for their product. If they’re not, you have two options: adapt your messaging to find common ground with the users you have, or adjust your acquisition channels to attract the users you need. Without behavioral data, you can’t make that decision rationally.

According to Gartner’s research on AI personalization, organizations that align their user acquisition strategy with behavioral segmentation data achieve 2–3x better unit economics than those that acquire users without segmentation. SmartCredit.io’s 2x conversion result is consistent with this finding.

Lesson 3: The Moment of Wallet Connection Is the Highest-Leverage Personalization Moment

The instant a user connects their wallet is the single highest-intent moment in their session. They’ve overcome wallet connection friction — they’re engaged. A generic response to that moment wastes the opportunity. A behaviorally personalized response — which Growth Agents deliver automatically — converts it.

Lesson 4: Personalization Compounds Over Time

The 8x and 2x results were measured at six months. The iterative optimization process means those numbers continue to improve as more behavioral data accumulates and more message variants are tested. Personalization is not a one-time campaign — it’s a compounding growth system.

How to Replicate This for Your Platform

The SmartCredit.io implementation followed a repeatable process. Here’s how any DeFi platform can replicate it:

Phase 1: Understand Your Users (Week 1–2)

Start with Web3 Behavioral Analytics. Add the pixel to your platform and let it run for 1–2 weeks. Review the behavioral breakdown of your existing users: their experience levels, risk profiles, behavioral categories, and predicted intentions. This is your baseline — and it will surprise you.

Phase 2: Define Your Personas (Week 2–3)

Map your Behavioral Analytics data to 3–5 distinct user personas. For each persona, identify: the product most relevant to their behavioral profile, the message frame that will resonate with their situation, and the CTA that reduces friction to the smallest possible step.

Phase 3: Deploy Growth Agents (Week 3–4)

Use ChainAware.ai’s Growth Agents to build personalized message sets for each persona and connect them to the behavioral triggers. Test your configurations using the free Wallet Auditor to verify that your personas are being correctly identified and served the right content.

Phase 4: For Developers — Go Deeper with Prediction MCP (Optional)

If your team wants full programmatic control over the personalization logic, integrate the Behavioral Prediction MCP directly. This gives you raw access to the same behavioral data that powers Growth Agents — prediction scores, Wallet Rank, Credit Score, fraud scores, protocol history — via a single MCP endpoint. Build custom AI agent flows, dynamic UI logic, or automated credit decisions on top of it. Full API documentation at swagger.chainaware.ai.

For a complete guide to this developer path, see our Prediction MCP complete developer guide.

Phase 5: Measure, Iterate, Expand (Ongoing)

Track conversion rates by persona, session depth by behavioral segment, and return rates week over week. Refine underperforming message variants. Expand to new behavioral signals as you accumulate data. The compounding effect becomes visible at the 60–90 day mark — and accelerates from there.

Conclusion: Behavioral Intelligence Is the DeFi Growth Lever

SmartCredit.io’s results — 8x engagement improvement, 2x conversion increase in six months — were not the product of a bigger marketing budget or a new product feature. They came from a fundamental upgrade in user intelligence: knowing who each wallet is, what it intends to do, and how to speak to it in a way that resonates.

ChainAware.ai’s Web3 Growth Agents and Behavioral Analytics make that upgrade accessible to any DeFi platform, without engineering complexity and without compromising user privacy. The behavioral data is already there on the blockchain. The question is whether your platform is using it.

Watch the full ChainAware.ai product overview: ChainAware.ai in 3 Minutes

Start Your Own SmartCredit.io Story

8x Engagement. 2x Conversions. Your Platform Is Next.

Growth Agents, Behavioral Analytics, and Prediction MCP — the same tools SmartCredit.io used to transform their DeFi platform. Start with a free wallet audit and see your users’ behavioral profiles instantly.