The advent of cryptocurrencies and blockchain technology has undoubtedly revolutionized the financial landscape, offering a plethora of opportunities for investment and innovation.

However, it has also opened up avenues for fraud and deceit. In this dynamic landscape, understanding and monitoring fraud score metrics stand as a vital tool in safeguarding assets and maintaining the credibility of the crypto space.

The Imperative for Fraud Score Metrics

With digital transactions witnessing a sharp rise, fraudsters are continually evolving their tactics to exploit vulnerabilities in the system. Trust score metrics serve as a sentinel in this scenario, offering a comprehensive view of the potential risks associated with different wallets and transactions. By relying on accurate fraud metrics, businesses and individuals can make informed decisions, avoiding traps set by scammers.

ChainAware.ai’s Pioneering Fraud Detection Algorithm

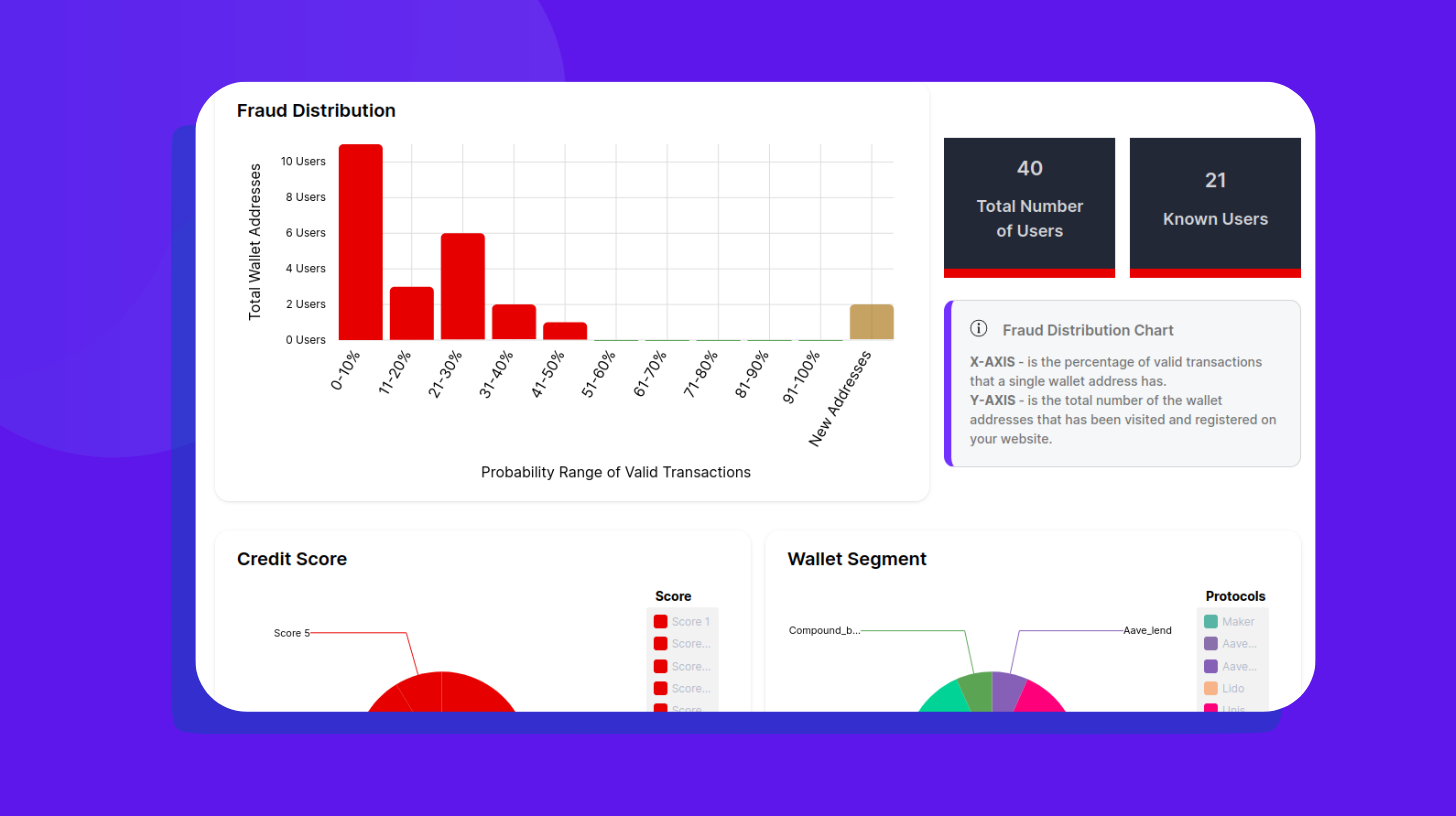

At ChainAware.ai, we have taken the responsibility of safeguarding the crypto community from potential frauds. Our sophisticated fraud detection algorithms analyze a plethora of data to calculate a trust indicator score ranging from 0 to 100 for wallet transactions. This score serves as a reliable yardstick to gauge the trustworthiness of wallet owners, providing a shield against fraudulent activities.

Read: A First Look at Our Dashboard

Potential Use Cases: Fortifying the Crypto Ecosystem

The use of fraud score metrics is not limited to preventing deceit; it finds applications across various sectors of the crypto industry. Here, we outline some of the prominent use cases:

- Crypto Lending: Before venturing into lending crypto assets, lenders can utilize fraud scores to ascertain the credibility of potential borrowers, thereby mitigating risks and fostering secure transactions.

- Investment Decisions: Investors can leverage fraud scores to evaluate the reliability of wallet owners before entering into transactions. This step ensures that investments are directed towards genuine and trustworthy entities.

- Compliance and Regulation: Regulatory bodies and compliance departments can use fraud score metrics as a tool to monitor transactions, ensuring adherence to laws and regulations, and maintaining the integrity of the crypto space.

- Account-Based Marketing: Web3 marketing managers can incorporate fraud score metrics into their strategies, allowing them to target reliable and high-balance crypto wallets, thus optimizing their marketing campaigns for success.

- Smart Contracts: Developers and smart contract creators can integrate fraud score metrics into their applications, establishing safety checks that prevent transactions with wallets having low trust scores.

Creating a Resilient Crypto Community

Beyond individual transactions, the widespread adoption of fraud score metrics has the potential to shape a resilient crypto community. By promoting transparency and accountability, these metrics can foster a culture where fraud is systematically rooted out, paving the way for a secure and prosperous crypto ecosystem.

Conclusion: Embracing Security with ChainAware.ai

In the race towards crypto supremacy, it is crucial to not overlook the aspects of safety and reliability. Trust score metrics stand as a beacon, guiding users to navigate the complex web of crypto transactions safely. At ChainAware.ai, we are dedicated to offering you a platform where you can access detailed fraud score metrics, empowering you to step into the future of crypto with confidence and security.

Join us in this journey towards creating a fraud-resistant crypto space, where innovation meets security, ushering in a new era of digital financial transactions characterized by trust and reliability.